Direct Cash Forecasting

Direct cash forecasting is a method of forecasting cash flows and balances used for short term liquidity management purposes. Direct cash forecasting, sometimes called the receipts and disbursements method of forecasting, aims to show cash movements and positions at specific future points in time.

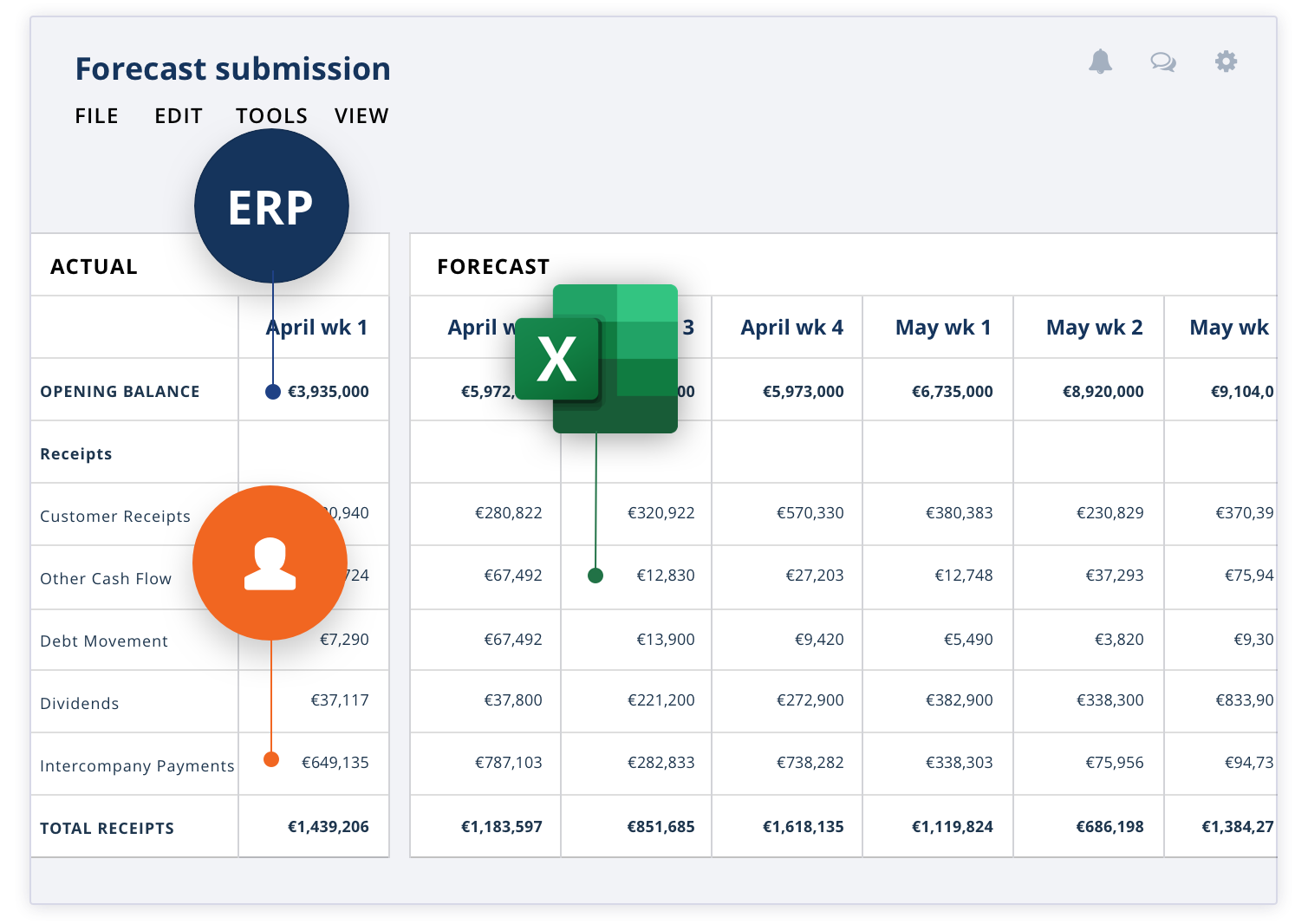

The inputs into a direct cash forecasting process are typically upcoming payments and receipts organised into units of time such as a day, week or month. These units of time are then aggregated to the length of time that the forecast is set to cover. The time frame for when a direct method of cash forecasting is useful is generally less than 90 days, however it may stretch to one year.

Indirect Cash Forecasting

An indirect cash forecast is one that is derived from a various projected income statements and balance sheets, generally done as part of the planning and budgeting processes. There are three methods of deriving an indirect cash forecast:

Adjusted Net Income (ANI): This is in effect a projected cash flow statement, it is derived from operating income, either EBIT or EBITA, changes on the balance sheet are then applied, such as Accounts Payable (AP), Accounts Receivable (AR) and inventories to forecast cash flow.

Proforma Balance Sheet (PBS): The PBS method looks at the projected balance sheet cash account at a future point in time. If all other balance sheet accounts have been projected correctly, cash will be too.

Accrual Reversal Method (ARM): The ARM is hybrid of the ANI and direct methods and uses statistical analysis to reverse large accruals and calculate the cash movements for individual periods.

What type of Forecasting Method to use?

In the very short term the direct method is a useful tool for treasury and cash managers to manage the day to day cash and funding requirements of a business and also assist with borrowing and investment decisions. Often actual cashflows are captured as part of the process and through variance analysis used to determine how accurate the forecasts are.

Medium term forecasts, either weekly or monthly are used for the purposes of liquidity management and assisting with investment decisions for companies with surplus cash. Medium term forecasts are also useful as an early warning signal for the purposes of covenant and net debt reporting.

Longer term indirect forecasts, greater than one year, are carried out on an accountancy basis. They are often linked to the strategic goals of the business, such as the capital expenditure that is accounted for over a number of years. The major downside of longer term forecasts is a drop off in accuracy.

Summary of Direct and Indirect Cash Forecasting

The key attributes of direct and indirect forecasts are summarised in the table below:

| Direct Forecasting | Indirect Forecasting | |

|---|---|---|

| Time horizon | Short to medium term, generally less than 1 year. | Longer term generally more than 1 year in the future. |

| What should it show? | Operational cash requirements and cash required to fund working capital. | Cash required to fund longer term growth strategies and capital projects. |

| How is it constructed? | Analysis of upcoming receipts/ debtors and payments/ creditors | Various income statement/ balance derivations (adjusted net income, pro-forma balance sheet etc.) |

| Pros | Easily understood. High accuracy can be achieved over short term periods. Can be very detailed and only focused on cash. Gives a forecast of cash balances at various points in the future. | Aligned to financial plans. Suitable for longer term planning |

| Cons | Can be difficult to reconcile with financial plans. Not an appropriate tool for longer term planning. | Accuracy not as high as direct forecasts. Difficult to perform variance analysis. Limited us in assisting with operational day to day cash management. Limited to the intervals of the financial plan. |

About CashAnalytics

CashAnalytics has helped many companies across a broad range of industries to build and maintain best-in-class cash forecasting processes that produce the highest quality reporting and analytics outputs.

Talk to an expert

To see an interactive demo of our software live in action, complete the form below and one of our account managers will be in touch find a time that suits you.