Harness the power of your SAP data for cash flow forecasting

CashAnalytics connects directly to SAP to make cash flow forecasting easier, faster and far more accurate.

CashAnalytics connects directly to SAP to make cash flow forecasting easier, faster and far more accurate.

Take the pain out of cash flow forecasting by automating manual cash forecasting and bank reporting tasks with CashAnalytics.

Manage all your cash flow data in one place for more cash visibility and deeper insights into what drives cash flow.

With all your cash flow data in one place, you will quickly see how and where cash flow can be improved across your business.

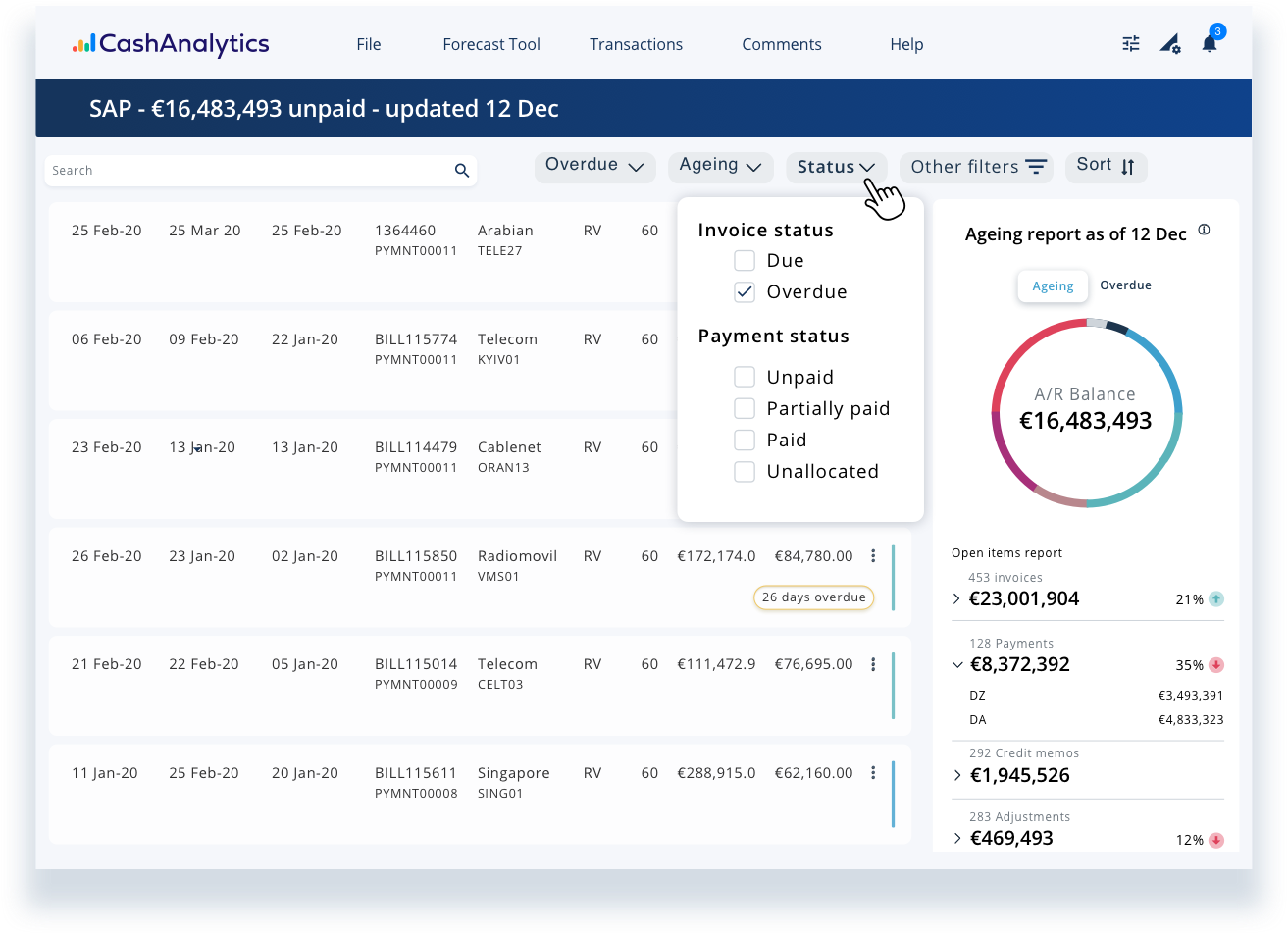

“The system can learn how your clients are paying and look at historic[al] patterns. You can understand how our customers pay, something that adds value not only from a forecasting perspective but broader cash management and working capital processes.” Eveline Stam, Group Treasurer

The simple setup, logic that is easy to understand for everybody in the process, and very flexible customization of the model are the main reasons why we like CashAnalytics so much.

With CashAnalytics you can just log in and see straight away the status of each country without needing to look at spreadsheets.

CashAnalytics is very customer focused and transformative. You get far more value than what you’re paying for. It is the perfect tool for companies of our size and complexity.

CashAnalytics provides a flexible, easy to handle cash forecasting solution that supports me and my colleagues reliably in our daily work.

I’d describe Cash Analytics as intuitive. The team is very knowledgeable and personable, there is a real willingness to help!

The amazing thing to come out of this harmonised process is the other processes that we can now support in Treasury. We can provide additional insight on payment management and intercompany management, and we have this information at the tip of our fingers … who is paying what to whom and where do the deviations lie.

People can really spend much more time analysing the business, really understanding it and making better decisions. It opens up so many new options for them. It’s like… ‘I was blind, now I can see.’ That’s the kind of feeling people get once they have used CashAnalytics.

The biggest challenge that we wanted to address was the time spent on tedious tasks. We wanted to find a tool that makes the entire process a lot easier. If you want to have a happy team, reliable data and to ensure that it’s coming through timelessly as well, then I’d definitely recommend CashAnalytics.

CashAnalytics gives us a real-time cash management system that is accurate each day.

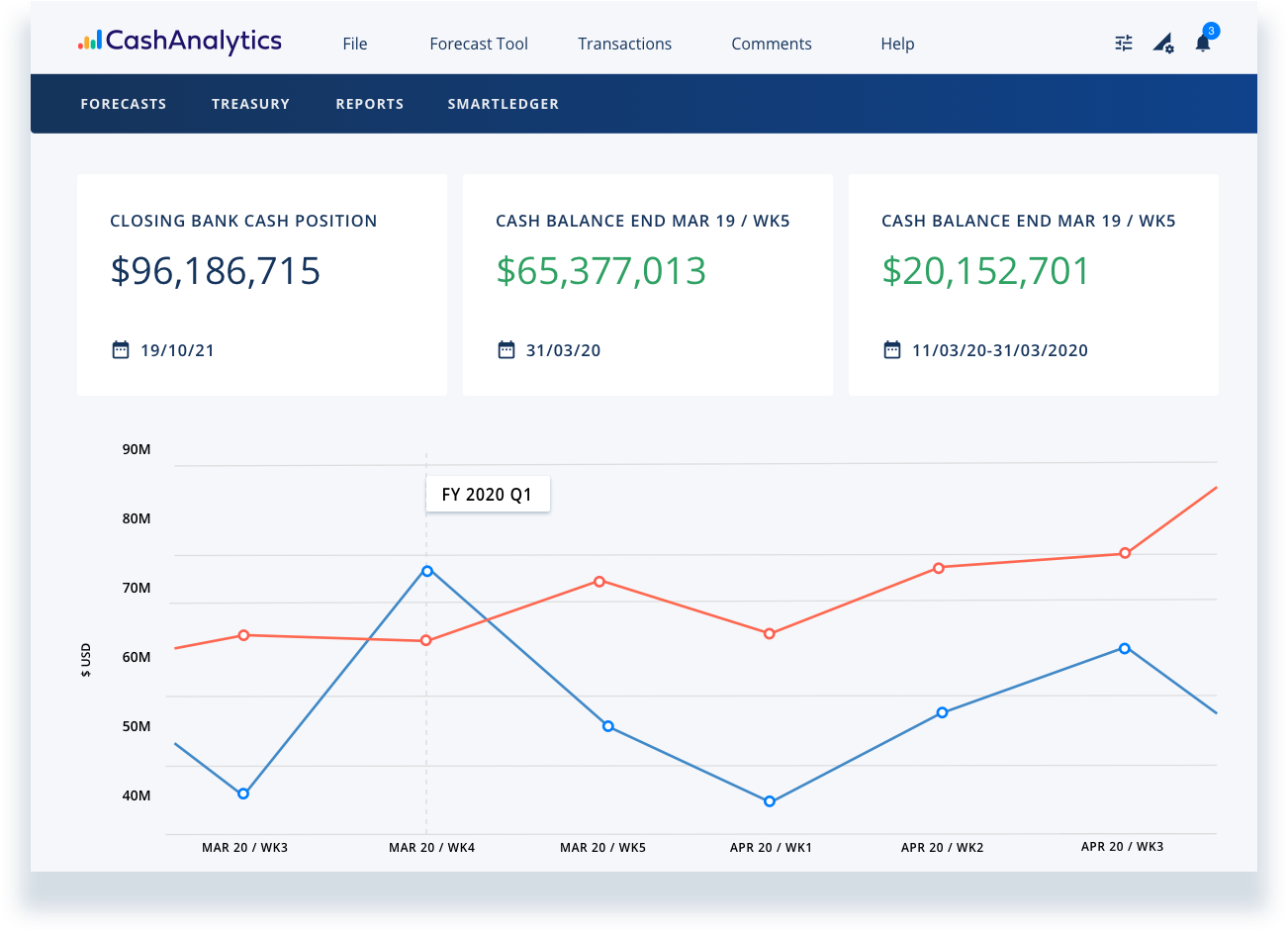

When I first saw the dashboard I got really excited. The key piece of information it shows, for us, is the total bank cash position. Then the ability to separate by entity is really useful for senior management because it allows us to see who is holding too much cash in the business and where we need to look at centralizing cash.

Get rid of your spreadsheets and manage your cash flow easily in one place.