13 weeks is the most popular cash forecasting time horizon.

This is because it strikes a balance between accuracy and range, allowing companies to forecast accurately enough to strengthen decision making, and offering a view into the future that stretches far enough to support medium-term planning.

Although we’ve covered the topic previously with our short article on the 13-week cash flow forecast, we decided we wanted to go further.

So, to demonstrate the true value of the 13-week cash flow forecast, we produced a whitepaper which can be downloaded here: 13-week cash flow forecast setup guide.

To give you a sense of what’s included in the guide, below you’ll find a high-level overview of the topics discussed.

Why companies use a 13-week forecast

As mentioned above, the main reason the 13-week cash flow forecast is so popular is the balance it achieves between range and accuracy.

In practice, this makes the 13-week forecast a key strategic tool to guide business decision making.

Because of the 13-week time horizon, the next quarter-end (a key reporting date for almost all companies) will always be covered by the forecast.

Additionally, many external parties may directly request a 13-week cash forecast from the company.

For example, a bank may request a 13-week forecast to gauge the companies covenant risk levels or ability to service its debts generally, as a key term of any funds the bank might lend to the company.

Private equity investors/ owners might also request a 13-week forecast which they can use as a proxy for the overall financial health of the company as well as the business is functioning in terms of it’s full cash conversion cycle.

Mapping out requirements

When setting up any new cash flow forecasting process, the first step is to understand the needs and requirements of all stakeholders in the process.

This should cover all users of and contributors to the forecast, as well as any senior management who would depend on the reports to which cash forecasts contribute (typically the CFO at a minimum, often the CEO and board as well, and sometimes also includes shareholders, investors, or private equity owners.)

What needs to be determined is what each of these stakeholders need to see, how often they need to see it, and what they actually use it for.

Determining the needs of these stakeholders upfront will ensure that the process meets its fundamental objectives.

Designing the 13-week model

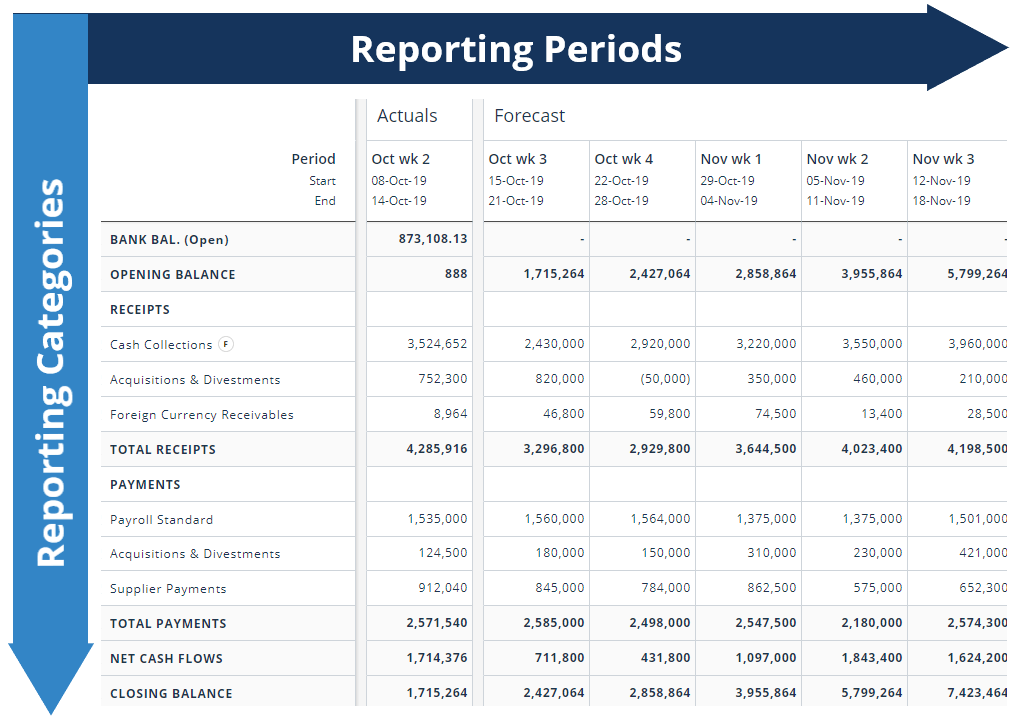

The forecasting model is the name given to the reporting structure and associated logic that produce the desired forecast output. The forecast model can be broken into two parts, these are:

- Model Dimensions (which present the output data, broken into reporting periods and reporting categories)

- Input Data (the forecasting model usually collects two types of cash flow data: actual and forecast).

As you can see from the above, the reporting categories are broken into inflows and outflows.

How each of the line items and headline rows are classified will depend on the requirements of the forecast mapped out earlier.

In the guide, we review in detail how each of the reporting categories can be broken into headline classifications, as well as what

granularity should be required in a variety of different scenarios.

Sources of data

As with any cash forecasting process, there are a wide variety of data sources that feed the 13-week cash forecast.

One of the goals of any new process should be to automate data inputs where possible and practicable.

Additionally, where full automation is not possible, steps should be taken to streamline the data input process. This is particularly important for a 13-week forecast because the data will need to be refreshed weekly.

To provide a full view of how each of these data sources affect the forecast, the guide examines each in turn, starting with actual cash flow data sources before reviewing the range of potential forecast data sources.

Putting the process in place

The foundation of any consistently good cash forecast is the process that underpins it.

The key to a good process is clear definition around who needs to provide what data, and the deadline by which they need to provide it.

As well as helping to ensure that data is always submitted in a timely fashion, having a clearly defined process will reduce the scope for error in execution.

As the process is being put into place, it is important that there is one clear and visible person at the helm of the process who is ultimately responsible for it.

In many cases, who this person should be is obvious (if it is the CFO, for example) but in the cases where it might feel better to share responsibility between a team, this impulse should be resisted.

Mainly, this is to ensure that an appropriately senior person will take individual responsibility for the quality and accuracy of the data, and will remain in charge to make improvements to the process as required.

About the guide

As mentioned at the start, the above is a broad overview of the topics discussed in the guide.

The guide itself examines each of these areas in detail and offers practical examples to help you to set up and manage a best practice 13-week cash flow forecasting process.

To download the guide please click here: 13-week cash flow forecast setup guide.

About CashAnalytics

As a specialist cash flow forecasting software provider, CashAnalytics has extensive experience in helping companies of a variety sizes, from a range of industries in setting up best practice cash flow forecasting processes.

If you would like to see a demonstration of our software, and hear about how you could achieve best practice within six weeks, please contact us directly.