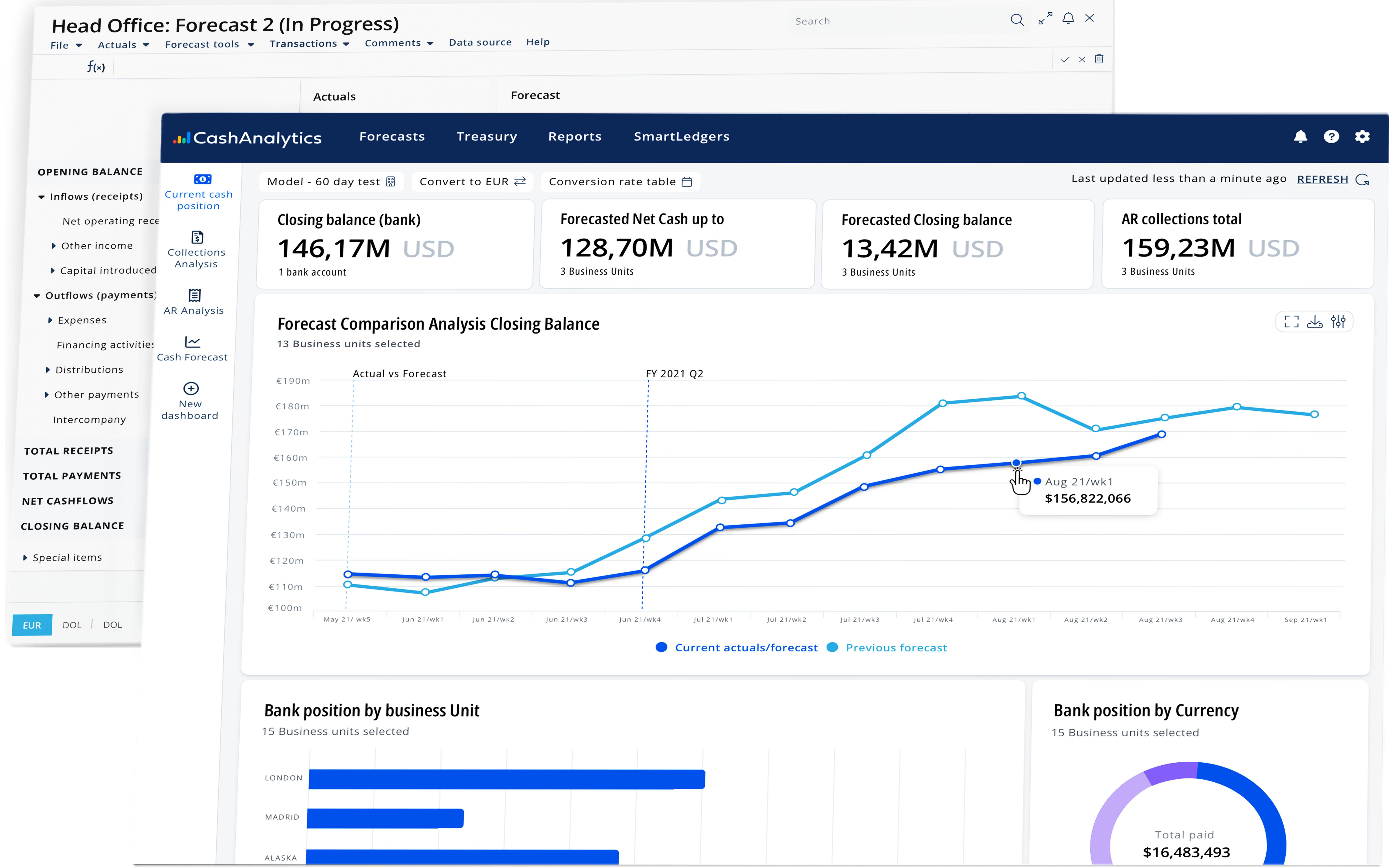

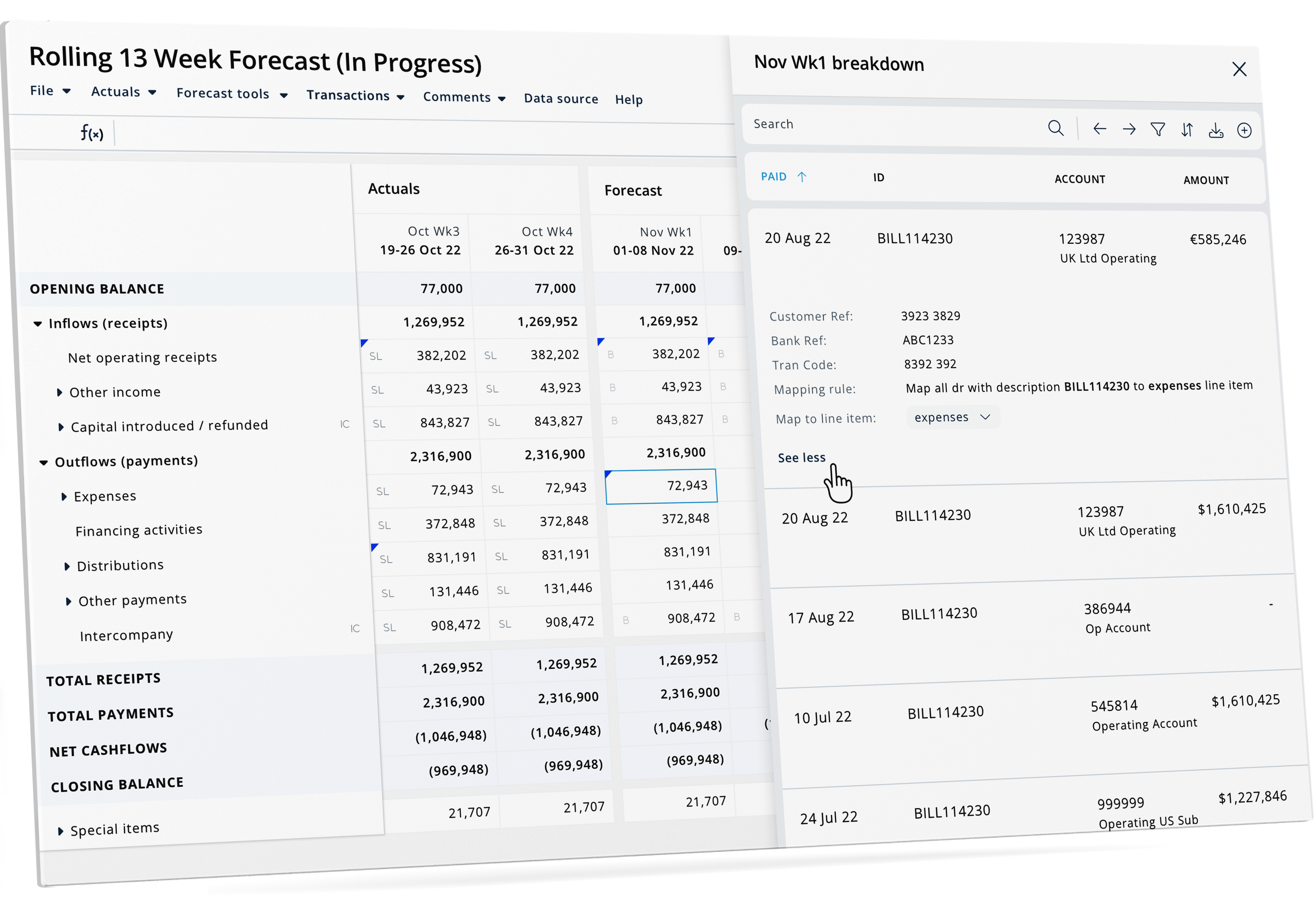

Flexible, Highly Automated Cash Flow Forecast Models

Flexible cash flow forecast models sit at the center of cash forecasting in CashAnalytics. Much like building a model in a spreadsheet, they can be customized to a very high level to suit your exact requirements. Unlike spreadsheets, the forecast models in CashAnalytics are highly structured and easily controlled with high levels of built in automation.