“People can really spend much more time analysing the business, really understanding it and making better decisions. It opens up so many new options for them. It’s like… ‘I was blind, now I can see.’ That’s the kind of feeling people get once they have used CashAnalytics.”

“People can really spend much more time analysing the business, really understanding it and making better decisions. It opens up so many new options for them. It’s like… ‘I was blind, now I can see.’ That’s the kind of feeling people get once they have used CashAnalytics.”

DAVINA BRADLEY

Group Treasurer at CEVA Logistics

CEVA Logistics is a global logistics and supply chain business founded in 2007 as a merger between TNT Logistics and EGL Eagle Global Logistics. The France-based firm specialises in worldwide freight management and contract logistics. To handle business around the world, CEVA depends on cash visibility.

The Challenge

Before using CashAnalytics, CEVA Logistics had no central visibility over their 1,100 worldwide bank accounts’ balances or activity. Some of the firm’s 150 business entities are located in countries that restrict access to bank accounts. As a multi-currency firm, this lack of transparency was a major problem. “If you don’t have cash visibility, you’re putting the business at risk,” said Davina.

The treasury team at CEVA Logistics was spending most of their time on lower-value activities with little visibility or real information about the business itself. They could not forecast cash flow at a group level.

“You can have lots of spreadsheets that you send to all of your business units and that you consolidate, but that’s very time consuming and very prone to errors. We’ve all looked at the spreadsheet with lots of links and macros, we found lots of errors…it can be and often is very messy”, said Davina.

It was hard to monitor the cash levels of the entities, which makes it even harder to understand what can be done with the cash in the business and, in turn, how to optimise working capital.

To create reliable short-term and long-term forecasting, CEVA’s team needed better cash visibility across their bank accounts in different currencies and an overview of business trends in each of their entities.

In 2021, the treasury team set out to implement a cash flow management and visibility transformation project, which was later recently recognised for its game changing results in cash forecasting visibility.

Key Requirements Overview

-

Roll out an automated forecasting system driven by digital innovation

-

Build better cash flow visibility within the business

-

Free up $100M idle cash to improve liquidity across business entities and drive growth

-

Reduce time spent on forecasting, and focus on higher-value activities like budgeting and policy-making

The Solution

CEVA Logistics implemented CashAnalytics as part of a wide-reaching cash flow management and visibility transformation project. The firm now has 100% visibility on cash balances and projected flow across more than 40 of its internal stakeholder entities.

CEVA Logistics used CashAnalytics to streamline its overall cash management. With this simplified structure, CEVA Logistics ultimately mobilised $100 million of idle cash and repaid debt.

Throughout the project, CashAnalytics worked closely with CEVA stakeholders to make sure all of their entities’ needs were met by the transformation. CEVA Logistics, alongside CashAnalytics, recently won the 2021 TMI award for Best Cash Visibility Solution.

100% Cash Flow Visibility

CEVA wanted its treasury team to have cash visibility on a weekly basis, so the firm implemented CashAnalytics. At the same time, the firm started reporting all of its bank statements in real time via SWIFT.

Eventually, CEVA Logistics rolled out CashAnalytics to 40+ key entities worldwide and connected SWIFT to all their key banking partners. With these updates, the firm had daily cash visibility (for both bank account balances and consolidated cash positions) through reports and dashboards.

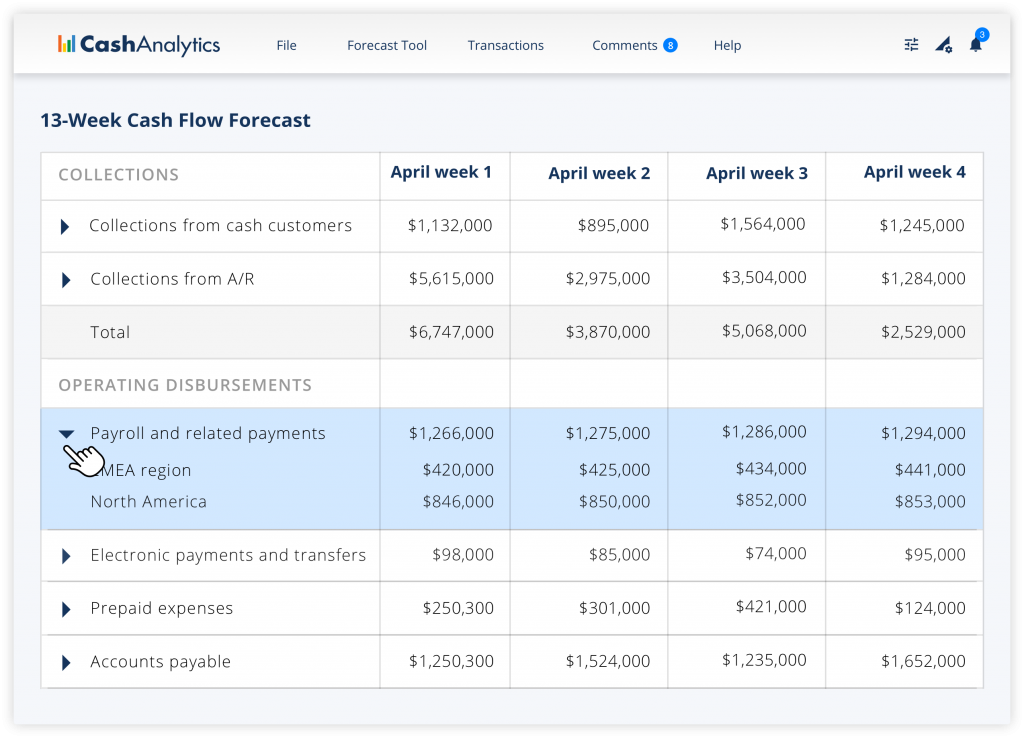

13-Week Multi-Currency Forecast Model Implementation

To gain the forecast visibility needed for ongoing cash and liquidity management within the business, CEVA Logistics implemented a 13- week rolling forecast model with CashAnalytics.

The firm adopted this brand-new cash forecasting process because it fully automated its data capture and reporting processes. CEVA’s treasury team now has 100% visibility over actual and medium-term (13-week) forecasting across the entire business — covering 40+ entities and 500 bank accounts. “Cash is king. Not having true cash visibility can be especially dangerous during trigger events; you can put the business at risk. So, for example, you believe you have a lot of cash in the business, but is that cash really, truly readily available?” said Davina.

Using CashAnalytics, CEVA’s treasury team was also able to provide variance analysis reporting to management on a per-entity basis.

Releasing $100M Idle Cash

With greater cash visibility, CEVA’s treasury team was able to unlock idle and unused cash. They used CashAnalytics to identify all of the company’s idle cash and then centralize it. The team secured $100 million, which CEVA used to fund working capital across the company.

This process wouldn’t have been possible with a spreadsheet solution, according to Davina. “You can have a lot of spreadsheets that you send to all of your business units and that you consolidate. But that’s very time consuming and prone to errors,” said Davina. “We’ve all looked at the spreadsheet with lots of links and macros and found lots of errors…it can be and often is very messy.”

Identifying and Managing FX Exposures

As an international multi-currency business, CEVA Logistics is prone to significant foreign exchange exposures. CashAnalytics enabled the firm’s treasury to proactively reduce overall FX exposures by providing clear visibility over per-currency cash balances and flows across its entire business.

With CashAnalytics, CEVA’s treasury team also ran a global FX review in 2021 and implemented new policies and controls that helped the firm reduce FX losses.

Pivoting to Higher Value Activities

After rolling out CashAnalytics, CEVA’s treasury team saved several hours and days per week on cash forecasting. The firm then reallocated the time saved to higher-value activities like budgeting available cash.

“It’s better to invest in a solution that you can implement quickly, that will be automated and user friendly,” said Davina.

Beyond saving time, the firm was also able to centralise bank payments and mandates. They also implemented new bank management and credit management policies.

User-friendly Forecasting and Reporting With CashAnalytics

Before using CashAnalytics, CEVA Logistics found cash management and forecasting difficult to handle for many subsidiaries and entities. With CashAnalytics, the firm’s cash forecasting and reporting process became consolidated and transparent across all entity levels.

CEVA’s treasury team can now monitor cash levels across their business entities, generate accurate liquidity reports, and use cash as a strategic asset for business growth.

“The good thing about a solution like CashAnalytics is that it really looks like Excel — you can literally copy and paste from your own Excel if you already have your template,” said Davina. “That makes it really easy and uncomplicated for new users. In five minutes, they know how to use the platform.”