A cash flow forecast is a tool used by finance and treasury professionals to get a view of upcoming cash requirements across their company. The main purpose of cash flow forecasting is to assist with managing liquidity, the larger the company the more complex and challenging cash flow forecasting becomes.

In this post we look at the main components of a cash flow forecast, the importance of actual cash flow data and a number of different types of cash flow forecasts.

Components of a Cash Flow Forecast

In its simplest form, a cash flow forecast will show you where your cash balances will be at certain points in the future. This helps highlight when and where funding needs arise and allows you to take advantage of times when excess liquidity is available. A more comprehensive cash flow forecast will show you where your cash is right now, where it’ll be in the future and what will happen along the way (e.g. classified cash receipts and payments). Typically a cash forecast will contain some or all of the following components:

• Opening Balance for the period;

• Receipts – broken down by cash flow item/ classification;

• Total Receipts;

• Payments – again broken down by cash flow item;

• Total Payments;

• Net Movement – either by individual cash flow item or at a minimum total net movement.

• Closing balance for the period.

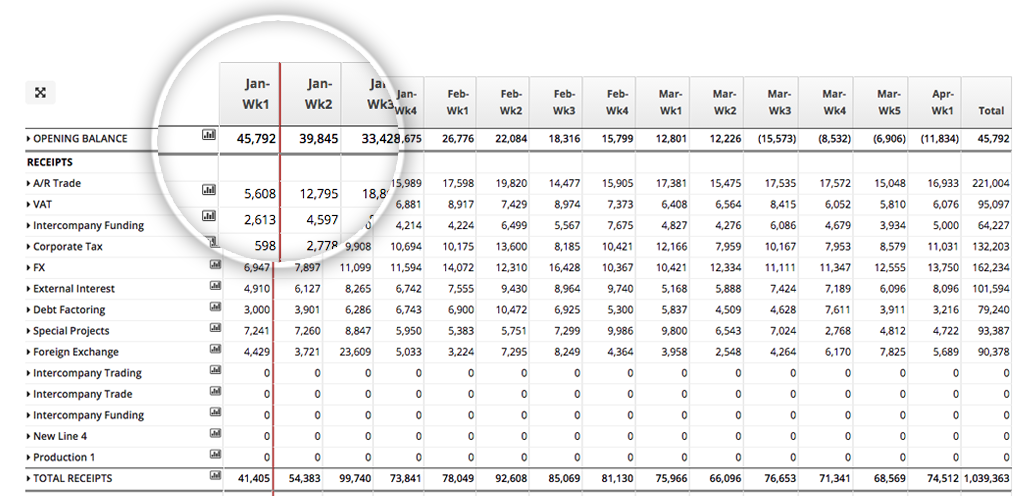

Broadly speaking, most cash forecasts will be structured as shown below. The image below shows a cross section of 13 week cash flow forecast:

The cash flow items that make up the receipt and payment elements are unique to a company’s forecasting needs. For example some companies would track high level Accounts Payable / Accounts Receivable cash flows and other companies would break the cash flows down to the level of individual customers and suppliers.

Actual Cash Flow Data

As well as capturing forecasted positions, cash flow forecasts often also capture actual cash flows in the same model or template. In the example above left of the red line indicates that the cash flows are actuals. The benefits of capturing actuals in a cash forecasting process are:

1. It ensures that the projected cash flows are starting from the actual cash flow position.

2. Historic cash flow data provides a good basis for making future projections.

3. Capturing actual cash flows means that you can compare what was forecasted to what was actually received allowing you to analyse the accuracy of the previous forecasts.

Types of Cash Flow Forecasts

When setting up a cash flow forecast the first decision that needs to be made is how far into the future the forecast will look. This will be determined by business needs and the availability of information within your organisation. Generally there is a trade-off between availability of information and forecast duration. The longer the forecast the less detailed the forecast is likely to be.

• Short term forecasts are used to manage the day-to-day cash needs of a business. Typically they look a couple of weeks into the future and contain a daily breakdown of cash payments and receipts. A daily forecasting process would often include a degree of automation capturing cash flows from bank accounts and ERP systems.

• Medium term forecasts such as rolling 13 week cash flow forecasts are extremely useful from a liquidity planning perspective. The 13 week period is important as it gives a quarterly view for each submission.

• Longer term forecasts such as a 12 month forecast is often the starting point for a budgeting process and is an important tool for assessing the cash required for longer term growth strategies and capital projects. The benefits of a long term forecast need to be balanced against the dependability of forecasts over a long period of time.

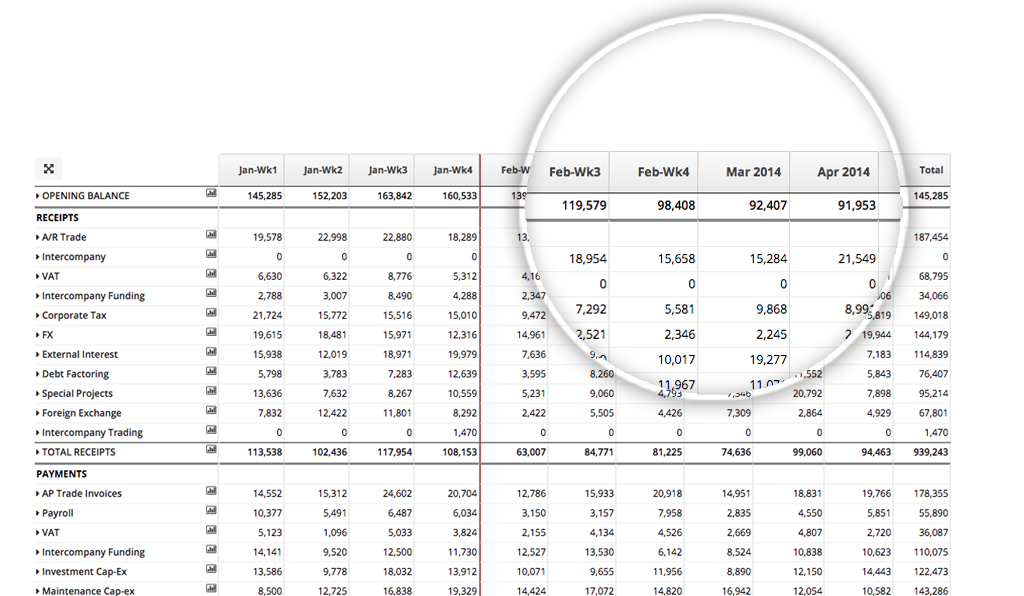

• Mixed period forecasts involve a combination of time periods. For example, a forecast spanning six weeks in total could contain two weeks of a daily cash flows and four weeks of weekly cash flows. This approach ensures detailed visibility where it matters most. An example of a mixed period cash forecast is shown below. This example covers a period of four months where cash flows are captured weekly in the first two months and monthly thereafter.

In most companies forecasts are collected on a weekly or monthly basis from business units. Forecasts can either be rolling or fixed term. A rolling cash flow forecast extends with each new submission and a fixed term forecast counts down to an end point such as quarter or year-end.

Summary

In summary, cash flow forecasts are the main tool used by companies for forward liquidity planning. Their format and duration vary depending on the exact nature of each businesses requirements. Finance teams structure their cash forecasts depending on what makes sense for them and what is important for the Treasurer, CFO and ultimately the CEO. A robust and accurate cash flow forecasting process, where accountability is built in, is an indicator of strong fiscal discipline in a company.