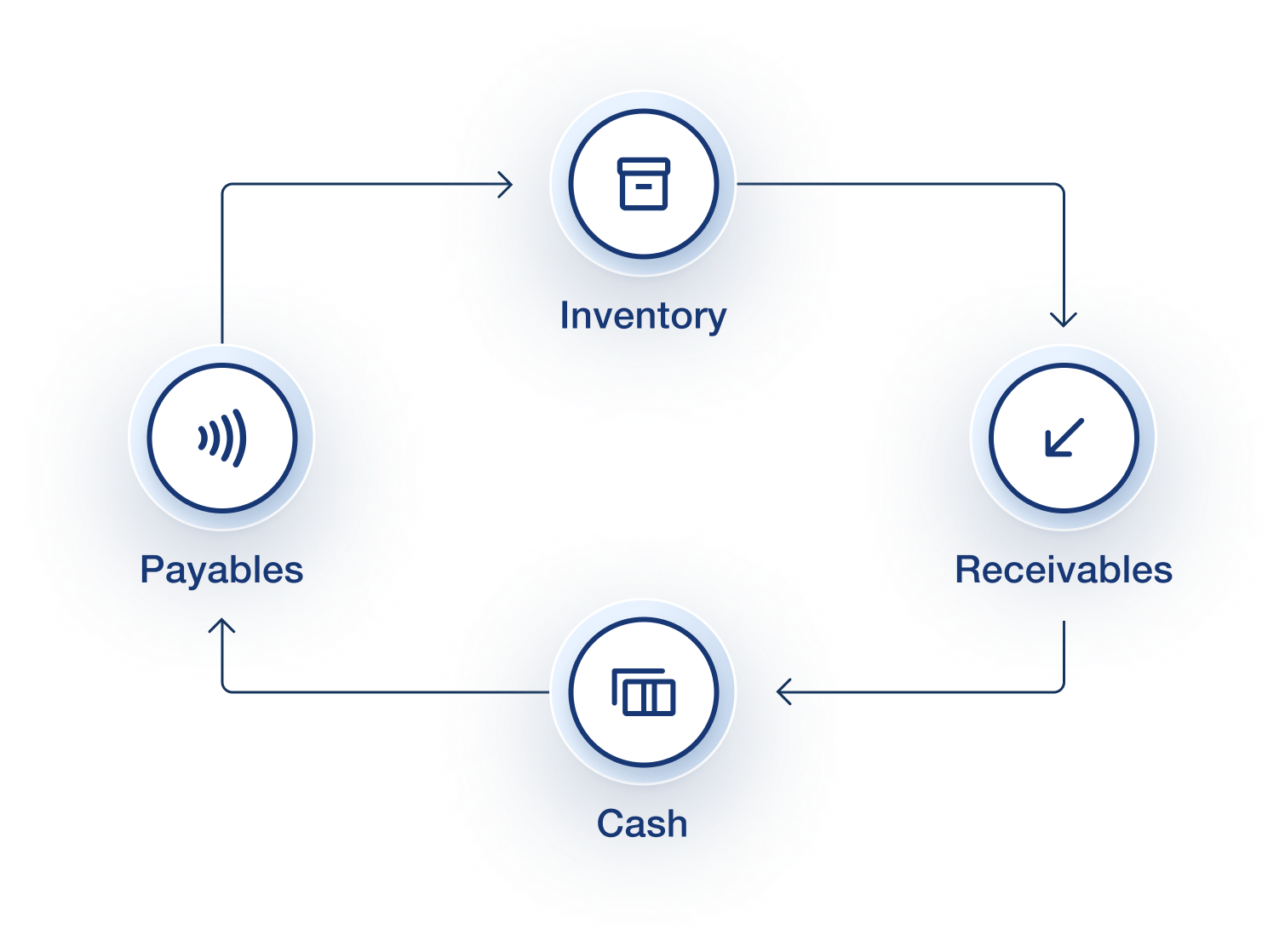

A business’s cash conversion cycle (CCC) is a measurement of how much time it takes to turn a cash investment in the business into a cash return in the form of sales.

If your business manages inventory, offers credit to customers and gets credit from suppliers, taking steps to improve your business’s CCC over time can increase cash flow, streamline operations, and provide a more stable platform for growth. Here’s how to calculate your business’s cash conversion cycle and the steps we most frequently recommend to improve it.

How to Calculate Your Cash Conversion Cycle

To calculate your cash conversion cycle, you’ll first need to determine the period you wish to calculate it for (i.e., for the quarter, the year, etc.). We typically recommend a period of 13 weeks since most businesses will have enough cash flow data to make an accurate calculation for that timeframe.

Next, you’ll need a handful of information from your income statements and balance sheets:

- Inventory value at the beginning/end of the period

- Accounts receivable at the beginning/end of the period

- Accounts payable at the beginning/end of the period

- Revenue for the period

- Cost of goods sold (COGS) for the period

With this information, we’ll calculate the individual metrics we need to determine your cash conversion cycle using the cash conversion cycle formula:

Cash Conversion Cycle (CCC) = DIO + DSO – DPO

Here’s how to calculate each entity in the equation above using the information you gathered from your financial reports.

Calculate Days Inventory Outstanding (DIO)

Days Inventory Outstanding is the average number of days it takes to sell your entire inventory. DIO is calculated using the following formula:

DIO = ((Beginning Inventory Value + Ending Inventory Value)/(COGS/2)) * Period

Generally speaking, the smaller your DIO is (i.e., holding on to inventory for less time), the more efficiently your business is converting working capital into inventory and back again.

Calculate Days Sales Oustanding (DSO)

Days Sales Outstanding (DSO) is the average number of days it takes for your business to collect payment from its customers. DSO is calculated using the following formula:

DSO = ((Beginning Accounts Receivable + Ending Accounts Receivable) / (Revenue*2)) * Period

Reducing DSO will accelerate cash flow into your business. So a smaller number is generally better here. For example, businesses that require immediate payment will have a DSO of zero, whereas businesses that provide net 15 or net 30 payment terms, for instance, will have a positive number for their DSO.

Calculate Days Payables Outstanding (DPO)

Days Payables Outstanding is the average number of days it takes for your business to pay its bills. DPO is calculated using the following formula:

DPO = ((Beginning Accounts Payable + Ending Accounts Payable)/COGS *2))* Period

Typically, the longer you have to pay your bills, the more it will shorten your cash conversion cycle, as it means you’re able to hold cash for longer after the sale of inventory. So, generally speaking, a larger DPO is better (more on when this may not be true when we talk about improving your CCC below).

Calculate Your CCC (An Example)

Once you have values for DIO, DSO, and DPO, simply plug them into the cash conversion cycle formula above to determine the average number of days it takes to invest cash into inventory and see a return.

For example, if it takes your business an average of 14.2 days to turn over inventory (DIO = 14.2), 15.6 days to receive payment from customers (DSO = 15.6), and 17.3 days to pay suppliers (DPO = 17.3), your cash conversion cycle would be 12.5 days (or 14.2+15.6 — 17.3).

What Is a Good Cash Conversion Cycle?

Generally speaking, a shorter cash conversion cycle is better than a longer one because it means a business is operating more efficiently. However, CCC is most useful as a measurement when benchmarked against past performance or compared to the CCC of industry competitors because it’s often influenced by factors beyond your organization.

For example, JP Morgan’s 2020 Working Capital Index report found that businesses saw their cash conversion cycle increase 5.3 days on average between 2018 and 2019. It noted that this increase is largely due to increases in inventory and extensions in payment collection, which were driven by market and regulatory changes.

So if your company had a cash conversion cycle of 45 days in 2019, that measurement wouldn’t tell you if it’s good or not on its own. You’d need to trend that against your CCC from previous years and the rest of your industry in order to understand it in context.

What Does a Negative CCC Mean?

A negative cash conversion cycle means that inventory is sold before you have to pay for it. Or, in other words, your vendors are financing your business operations.

A negative cash conversion cycle is a desirable situation for many businesses. However, in practice, it is difficult for most businesses to achieve without taking extreme (unsustainable) action. So rather than focusing on driving your cash conversion cycle into the negative (or even zero), it’s better to focus on reducing it sustainably and benchmarking to determine how you’re doing.

How to Shorten Your Cash Conversion Cycle (Sustainably)

To shorten your CCC, you should closely monitor and improve working capital metrics like DSO, DIO, and DPO. However, it’s important to note that many of the obvious steps for improving these actions can end up hurting you in the long run if taken too far.

For example, extending the amount of time you have to pay vendors helps extend DPO. So it’s the first place many businesses will make changes. However, delaying payments to vendors too much can damage your business relationships and impact their ability to provide the goods or services you require to produce your own.

Similarly, ramping up cash collections from customers will help improve DSO. But aggressive cash collection could damage relationships with customers and result in a loss of business. Not to mention, aggressive cash collection is time-consuming and cost-intensive, which reduces the overall benefit of obtaining a shorter CCC in the first place.

We’re not saying these methods for improving your cash conversion cycle are bad. In fact, revisiting payment terms with customers and vendors is an essential part of improving your cash conversion cycle. However, they should be optimized incrementally over time (and balanced with other actions, outlined below) rather than used as a short-term stopgap.

1. Evaluate Vendor Health and Stability

Reliable vendors make it easier to optimize production and the rest of your supply chain in order to minimize your cash conversion cycle. For example, if you can count on a vendor to deliver when they say they will, it makes it easier to optimize production campaigns in order to reduce the amount of time inventory sits before it’s sold.

Financially healthy vendors also help reduce the risk of supply chain disruptions that could impact your bottom- and top-line revenues.

2. Evaluate Invoicing and Accounts Receivable Processes

If it’s hard for your customers to pay you, it will generally take longer for them to do so. So to shorten your DSO and cash conversion cycle, it’s important to regularly review your accounts receivable and invoicing processes to ensure they work for your customers.

Make sure your invoices are accurate, contain all of the information your clients need, and are sent on time. Use electronic payments, if possible, to streamline the payment process.

3. Reassess Customer Credit Criteria

Customers with healthy, stable businesses are more likely to pay you on time. So revising the customer credit criteria and the policies for new customers can improve the quality of the customers you engage with and help reduce the amount of time it takes to get paid.

Be sure to consult your sales and customer success teams about any changes you make to customer payment terms, credit changes, or payment processes. You’ll want to ensure any changes you make won’t impact their ability to close deals or retain clients.

4. Streamline Inventory Management Processes

Reducing the amount of time it takes for inventory to turn over will reduce your cash conversion cycle. For this reason, many businesses adopt a “just-in-time” approach to inventory management to minimize the amount of time inventory sits before selling.

However, while reducing the amount of time inventory sits is a key part of streamlining inventory turnover, there is a limit to how “just-in-time” inventory replenishment can be before a single disruption could wreck your top- and bottom-line revenues. For example, if a raw material input arrives late to the production process, the entire production of the finished product could be delayed or halted, which could impact customer relationships.

Instead, it’s better to hold more stock and reassess your demand forecasts on a regular basis with historical data to ensure production campaigns and replenishment timing are both optimized without putting the business at risk.

Sustainable CCC Improvements Require Reliable Real-Time Data

Without accurate, real-time data close at hand, it’s hard to see how small adjustments today can help you improve your cash conversion cycle for the long term.

However, drawing insights from data that will yield improvements in real-time is challenging for most mid- to large-sized businesses that need to collect, manipulate, and analyze massive data sets by hand in order to do so. It’s why automating the collection of financial data and reporting has greatly simplified our clients’ efforts to optimize their cash flow processes.