A Cash Flow Forecast is a tool that is used by a company to help them understand where their organisations cash balances will be at certain points in the future. A cash flow forecast breaks down the various components involved in deriving what will make up or contribute to a future cash position. Normally within larger companies it would be the responsibility of the finance or treasury team to prepare the cash flow forecast.

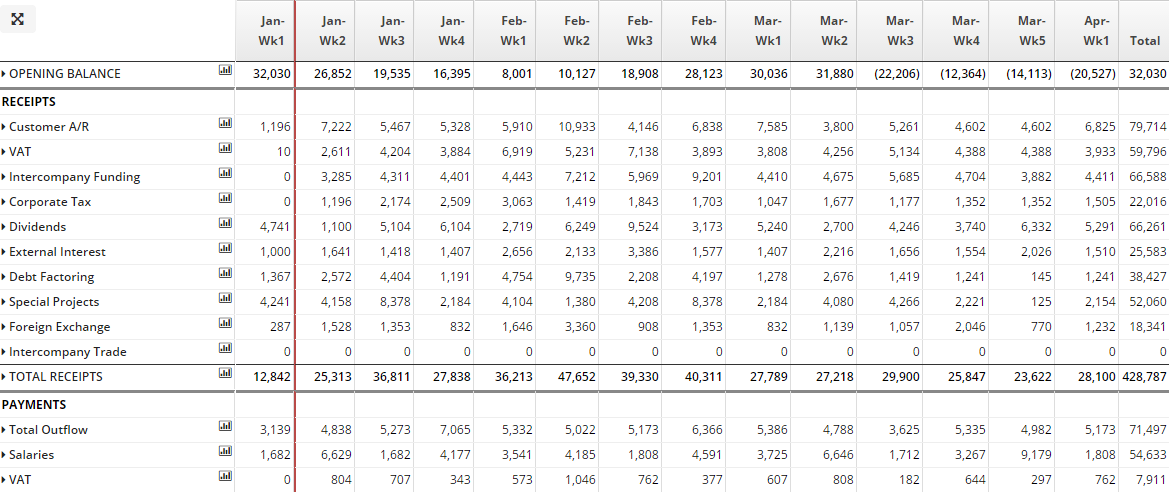

Normally a cash flow forecast is prepared in a grid like structure with the cash classifications or cash flows on the y axis and the periods of time being forecasted on the x axis. The image below shows a cross section of a 13 week rolling cash forecast.

Key Elements of a Cash Flow Forecast

As can be seen in the image above, typically a cash forecast will contain some or all of the following components:

• Opening Balance for the period;

• Receipts – broken down by cash flow item/ classification or by customer;

• Total Receipts;

• Payments – again broken down by cash flow item or by supplier;

• Total Payments;

• Net Movement – either by individual cash flow item or at a minimum total net movement.

• Closing balance for the period.

Time Periods of a Cash Flow Forecast

The time periods for which the forecast projects cash flows for, typically runs across the top of the forecast. For example, the image above shows a 13 week cash flow forecast. The time periods of a forecast often depend on its purpose and function, whether it is short, medium or long term in focus.

Templates for cash flow forecasts include:

• Daily, often 2-4 weeks in duration a daily cash forecast is very useful to help manage the day to day cash needs of a company;

• Weekly, typically 13 weeks in duration. Weekly cash forecasts are useful from a liquidity planning perspective;

• Monthly forecasts are often the starting point for budgeting processes and tend to have a longer view in terms of their frame of reference;

Cash flow forecasts come in a number of shapes and sizes. The duration and level of detail within a forecast is generally driven by business needs in an organisation. The benefits of each type of forecast need to be weighed up against the dependability of the information over the the time period and the the goals and objectives that the forecast is designed to address.